Investment Professionals

Clients

In Asset Under Management

Our Business

Fund Management

Azimut manages a set of funds and actively managed certificates (AMC) with a focus on Asian Equities and Fixed Income, capitalizing on global expertise and a three-decade track record across developed and emerging markets. Our investment approach includes growth, value, quality and thematic styles with the additional benefit of sector and single country strategies The Fund’s investment objective is to provide capital appreciation with long and short positions on indices representative of various asset classes such as equities, bonds, currencies and commodities.

For more information, please visit https://www.azimutinvestments.com/

Wealth Management

Azimut provides an External Asset Management (EAM) platform for veteran Private Bankers which allows them to provide to their clients:

Assurance Of Independence

Flexibility and a Highly

Personalized Client Service

In-House

Investment Team

Middle & Back

Office Support

In-house

Compliance Checks

Direct Access To Various

Custodian Bank's Offering

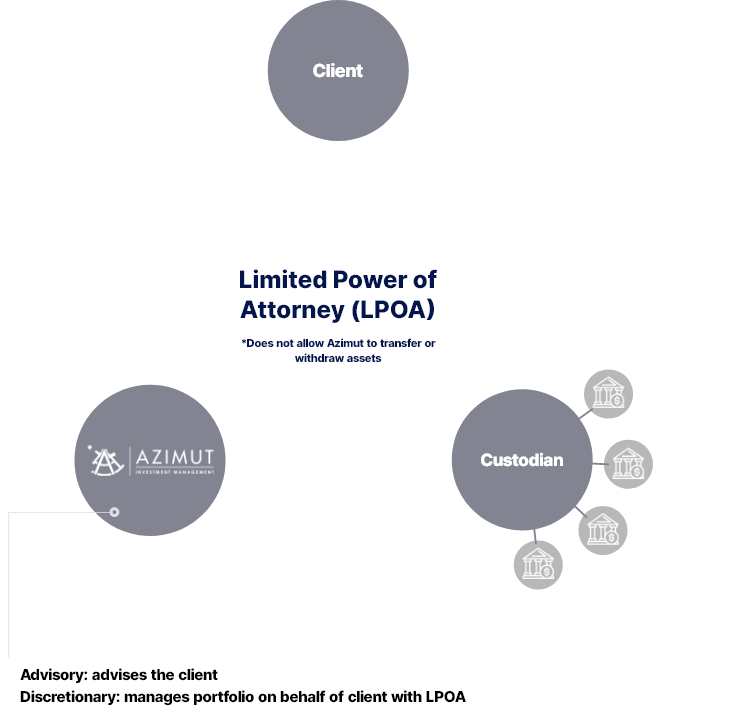

What is External Asset Management (EAM)?

Under the EAM Business Model, we help clients to open accounts with our partner custodian banks. This is a normal account held under the client’s direct name. Subsequently, the client signs a Limited Power of Attorney (LPOA), which allows Azimut to manage the client’s investment portfolio and asset allocation as a third party.The LPOA is limited as it does not allow Azimut to transfer or withdraw the assets.

CONTACT US

We’d love to hear from you

marketing@azim.sg

hr@azim.sg